Archive for September, 2010

2010-09-30 Taiwan to agree Carlyle Group’s sale of Kbro

Zain Likely To Sell 46% Stake To Etisalat Today

Thursday, September 30th, 2010

According to recent reports, Zain shareholders may approve a bid from Etisalat for 46% stake for a price of about $10.5 billion. A person familiar with the deal said Zain shareholders are preparing to send a letter of acceptance today.

According to recent reports, Zain shareholders may approve a bid from Etisalat for 46% stake for a price of about $10.5 billion. A person familiar with the deal said Zain shareholders are preparing to send a letter of acceptance today.

Etisalat confirmed yesterday that it had made a “conditional offer” for a stake in Zain. The transaction is expected to boost Etisalat’s presence in the Middle East and extend its reach to countries where Zain operates like Kuwait, Bahrain, Iraq… etc.

Nasser Al-Kharafi, Chairman of Kuwait’s Kharafi Group the second largest shareholder in Zain with about 13%, told Al-Qabas newspaper that Etisalat’s offer is “suitable and good for both parties”.

Etisalat is active in more 18 countries across the Middle East, Africa and Asia and serves more than 100 million customers. The UAE accounts for 86% of Etisalat’s sales.

Zain had sold most of its African assets to India’s Bharti Airtel for $9 billion. Its largest shareholder is Kuwait Investment Authority, the country sovereign wealth fund, with 24.6%.

ETB eyes Television market in Colombia

Thursday, September 30th, 2010 In an interview for La Republica, Fernando Carrizosa President of ETB, explained the plans for the company in short term. In addition to consolidating its leadership in corporate segment and upgrading the speed of broadband, ETB plans to develop a TV platform.

In an interview for La Republica, Fernando Carrizosa President of ETB, explained the plans for the company in short term. In addition to consolidating its leadership in corporate segment and upgrading the speed of broadband, ETB plans to develop a TV platform.

ETB is looking at different models on its TV service. First an alliance with DirecTV, which will allow ETB to offer 3-Play service easily as competitors are doing. Another possibility is to develop its own TV platform, for this purpose, there are several alternatives. By using its network to develop IPTV, or develop a satellite offer in partnership with satellite companies or its own satellite developement. All of these models are in discussions and analyzed according to the debt capacity and return on investment.

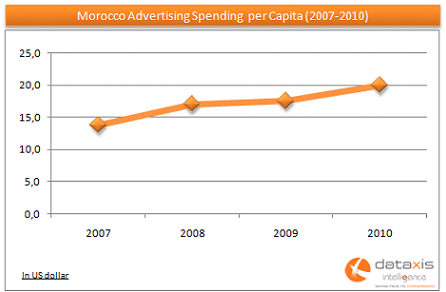

Morocco Advertising Expenditure Grows 20% in H1 2010

Thursday, September 30th, 2010Morocco Advertising Expenditure increased by nearly 20% in the first half of 2010, reaching MAD 2.5 billion (US$ 295 million) in June, according to media professionals. The telecom sector, which traditionnally accounts for 30% of ad spending, was one of the heaviest investors during this six-month period, as Morocco’s third telecom operator Wana launched a new GSM offer under the name of Inwi.

Among all media, Television was the one that benefited most from the rebound in ad sales. TV channel 2M, which was established in 1989 by the largest Moroccan economic conglomerate ONA before being sold to the state 7 years later, saw its ad revenues jump 35% in H1. Al Aoula, owned by Morocco’s public broadcaster SNRT, enjoyed a 20% increase in advertisng sales in the first semester. However, for the newspaper and magazine sector, ad expenditure stalled, as the industry faced an increasing competition from outdoor (30% in H1) and a rising popularity of radio in Morocco (+9% in H1).

Among all media, Television was the one that benefited most from the rebound in ad sales. TV channel 2M, which was established in 1989 by the largest Moroccan economic conglomerate ONA before being sold to the state 7 years later, saw its ad revenues jump 35% in H1. Al Aoula, owned by Morocco’s public broadcaster SNRT, enjoyed a 20% increase in advertisng sales in the first semester. However, for the newspaper and magazine sector, ad expenditure stalled, as the industry faced an increasing competition from outdoor (30% in H1) and a rising popularity of radio in Morocco (+9% in H1).

In 2009, the advertising market registerd a slow yet positive growth in revenues; ad spending went from a 25% increase in 2008 to a 5% growth last year. The slowdown was mainly caused by multinational companies that cut down their ad spending, whereas the predominance of local advertisers in the media industry has played a key role in cushioning the impact of the crisis on the Moroccan market.

.

.

Detailed figures and analysis of Q2 2010 pay and free TV revenues worldwide will soon be available through Dataxis Intelligence’s market research service.

.

Mobile market continues to grow steadily in Finland

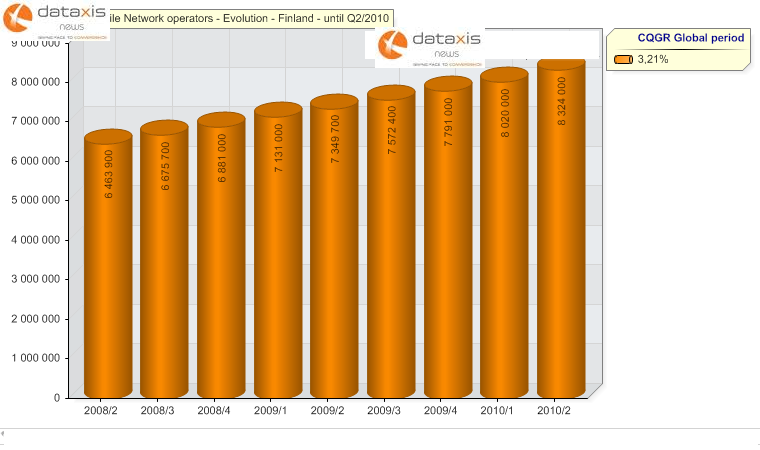

Wednesday, September 29th, 2010Finland, one of the most advanced mobile communications markets continues to impress by its steady growth despite the difficult economic times that hit the developed countries during the last two years. In fact the homeland to Nokia, has demonstrated strong buoyancy in the last twelve consecutive quarters, since subscriptions to mobile phone services jumped by nearly 30% to reach over 8.3 million as of June 2010 (See the chart below).

In absolute terms, it means that the Finnish mobile market attracted about 2 million new users in the referred period which on average represents more than 165,000 net additions per quarter.

As a result, the mobile penetration rate in the country rose from 121% to roughly 155% of the population, thus positioning it as one of the top adopters of mobile phone services worldwide.