Dataxis Views

MTG Q3 revenues up 17% on improved Free-TV results

Wednesday, October 20th, 2010

Leading media company Modern Times Group (MTG) has just released its results for the third quarter and nine months ended 30 September 2010.

Leading media company Modern Times Group (MTG) has just released its results for the third quarter and nine months ended 30 September 2010.

Q3 Revenues were up 11% year on year to SEK 3,531 million (€381 million), up 17% year on year at constant exchange rates. Results were driven by a 17% increase in Free-TV Scandinavia third quarter revenues, which reached SEK 922 (€99 million), up 22% year on year at constant exchange rates.

The group’s net income for the quarter was up 42% year on year to SEK 360 million (€38.8 million).

Hans-Holger Albrecht, President and Chief Executive Officer, commented: “Our record Q3 sales reflected constant exchange rate sales growth across each of our business areas in the seasonally smallest advertising sales quarter of the year. We also reported healthy incremental operating margins. The performance was once again led by our Scandinavian free-TV operations, which capitalised on strong advertising demand and rising pricing levels”.

Mr. Albrecht added that MTG’s Emerging Markets free-TV business reported a second consecutive quarter of year on year growth in stable market conditions, as well as an improved operating result.

With regard to the Nordic pay-TV business, the results reflected continued net IPTV subscriber intake and rising DTH premium ARPU levels, with the Swedish operations beginning to benefit from the recent acquisition of the English Premier League football rights. The Nordic pay-TV business reported a higher than anticipated operating margin in the quarter, whilst the performance of the Emerging Markets pay-TV business reflected the consolidation of the Russian and Ukrainian satellite platforms.

.

Detailed figures and analysis of Q2 2010 pay and free TV revenues worldwide are now available through Dataxis Intelligence’s market research service.

Digital Cable Subscribers reached 3 million in Korea in June 2010

Thursday, October 7th, 2010

The Digital Cable market in South Korea is very competitive with tens of Cable systems operators. In June 2010, this market reached 3 million subscribers, in a 15.225 million cable subscribers market. It represents a digitalization of 20%.

The Digital Cable market in South Korea is very competitive with tens of Cable systems operators. In June 2010, this market reached 3 million subscribers, in a 15.225 million cable subscribers market. It represents a digitalization of 20%.

CJ Cablenet continue to lead the digital cable market with 903.300 subscribers but is followed just brhind by C&M with 865.900 subscribers. KDMC is the largest cable operator with more than 3.353 million cable subcribers but its digitization is low compared to its competitors.

On other side, IPTV reached 2 million subscribers milestone. Live IPTV was launched in Korea end 2008, so with this successful growth, we can predict that IPTV will probably surpass Digital Cable subscriber base.

Cable Digital merket in Q210 :

|

Q2 2009

|

Q2 2010

|

Net adds YoY |

|

Cable subs |

inc. Digital |

Cable subs |

inc. Digital |

Analogue |

Digital |

| KDMC |

2 843 000

|

227 000

|

3 353 000

|

534 000

|

510 000

|

307 000

|

| CJ Cablenet |

2 523 300

|

750 600

|

3 085 000

|

903 300

|

152 700

|

152 700

|

| C&M |

2 164 000

|

663 700

|

2 145 200

|

865 900

|

- 18 800

|

202 200

|

| CMB |

1 273 500

|

9100

|

1 303 400

|

43 800

|

29 900

|

34 700

|

| HCN |

1 374 000

|

220 400

|

1 343 500

|

342 000

|

- 30 500

|

121 600

|

| On Media |

568 000

|

23 400

|

564 500

|

31 000

|

- 3 500

|

7 600

|

| Qrix |

629 000

|

148 200

|

640 000

|

179 000

|

11 000

|

30 800

|

| Others |

3 491 000

|

100 000

|

2 791 300

|

108 000

|

- 699 700

|

8000

|

| TOTAL |

14 861 500

|

1 783 560

|

15 225 900

|

3 097 000

|

364 400

|

1 313 440

|

Source : Dataxis Intelligence

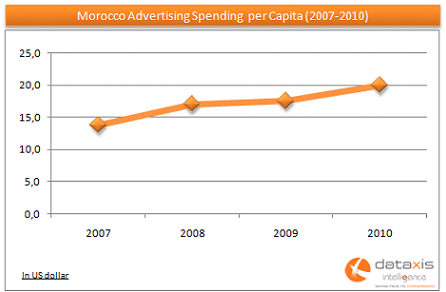

Morocco Advertising Expenditure Grows 20% in H1 2010

Thursday, September 30th, 2010

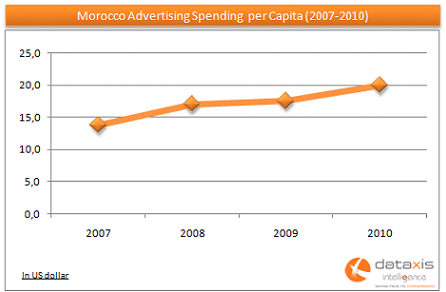

Morocco Advertising Expenditure increased by nearly 20% in the first half of 2010, reaching MAD 2.5 billion (US$ 295 million) in June, according to media professionals. The telecom sector, which traditionnally accounts for 30% of ad spending, was one of the heaviest investors during this six-month period, as Morocco’s third telecom operator Wana launched a new GSM offer under the name of Inwi.

Among all media, Television was the one that benefited most from the rebound in ad sales. TV channel 2M, which was established in 1989 by the largest Moroccan economic conglomerate ONA before being sold to the state 7 years later, saw its ad revenues jump 35% in H1. Al Aoula, owned by Morocco’s public broadcaster SNRT, enjoyed a 20% increase in advertisng sales in the first semester. However, for the newspaper and magazine sector, ad expenditure stalled, as the industry faced an increasing competition from outdoor (30% in H1) and a rising popularity of radio in Morocco (+9% in H1).

Among all media, Television was the one that benefited most from the rebound in ad sales. TV channel 2M, which was established in 1989 by the largest Moroccan economic conglomerate ONA before being sold to the state 7 years later, saw its ad revenues jump 35% in H1. Al Aoula, owned by Morocco’s public broadcaster SNRT, enjoyed a 20% increase in advertisng sales in the first semester. However, for the newspaper and magazine sector, ad expenditure stalled, as the industry faced an increasing competition from outdoor (30% in H1) and a rising popularity of radio in Morocco (+9% in H1).

In 2009, the advertising market registerd a slow yet positive growth in revenues; ad spending went from a 25% increase in 2008 to a 5% growth last year. The slowdown was mainly caused by multinational companies that cut down their ad spending, whereas the predominance of local advertisers in the media industry has played a key role in cushioning the impact of the crisis on the Moroccan market.

.

.

Detailed figures and analysis of Q2 2010 pay and free TV revenues worldwide will soon be available through Dataxis Intelligence’s market research service.

.

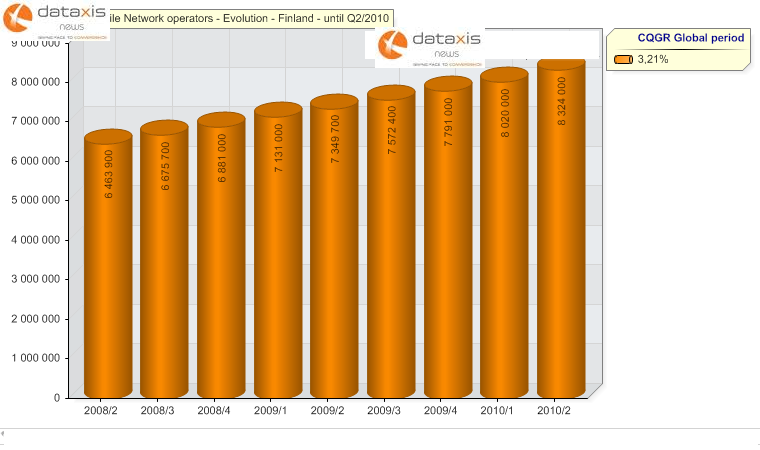

Mobile market continues to grow steadily in Finland

Wednesday, September 29th, 2010

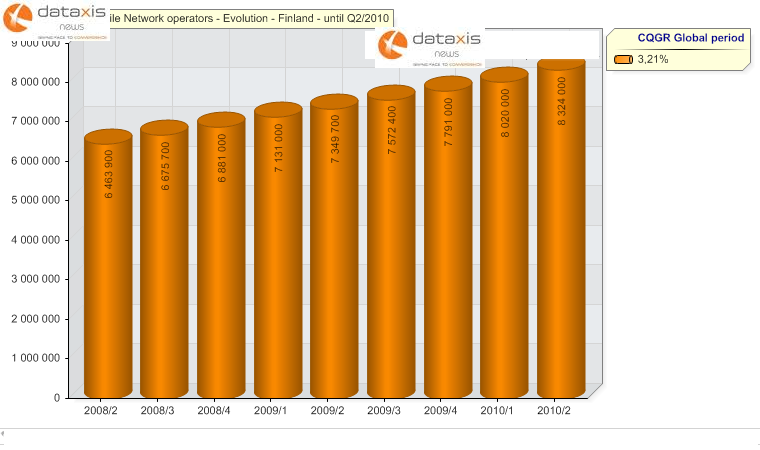

Finland, one of the most advanced mobile communications markets continues to impress by its steady growth despite the difficult economic times that hit the developed countries during the last two years. In fact the homeland to Nokia, has demonstrated strong buoyancy in the last twelve consecutive quarters, since subscriptions to mobile phone services jumped by nearly 30% to reach over 8.3 million as of June 2010 (See the chart below).

Finland, one of the most advanced mobile communications markets continues to impress by its steady growth despite the difficult economic times that hit the developed countries during the last two years. In fact the homeland to Nokia, has demonstrated strong buoyancy in the last twelve consecutive quarters, since subscriptions to mobile phone services jumped by nearly 30% to reach over 8.3 million as of June 2010 (See the chart below).

In absolute terms, it means that the Finnish mobile market attracted about 2 million new users in the referred period which on average represents more than 165,000 net additions per quarter.

As a result, the mobile penetration rate in the country rose from 121% to roughly 155% of the population, thus positioning it as one of the top adopters of mobile phone services worldwide.

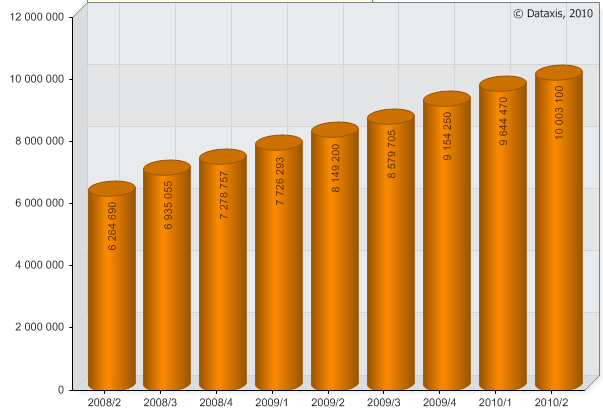

Broadband Cable subscribers reached 10 million in Latin America in June 2010

Tuesday, September 28th, 2010

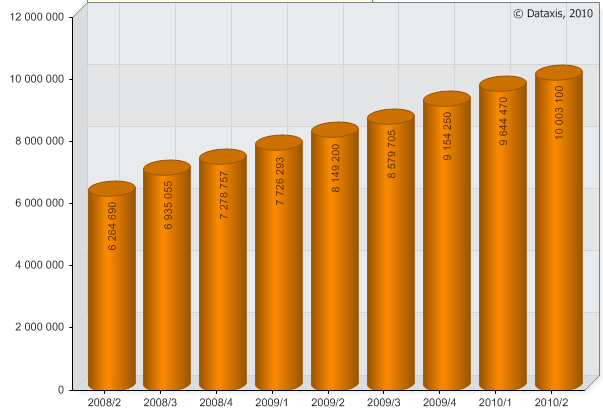

According to Dataxis Intelligence, Latin America reached 10 million broadband cable subscribers in half year of 2010. Historically, cable television is the most popular platform in Latin America, thus the cable network has an important potential for the expansion of internet cable.

According to Dataxis Intelligence, Latin America reached 10 million broadband cable subscribers in half year of 2010. Historically, cable television is the most popular platform in Latin America, thus the cable network has an important potential for the expansion of internet cable.

The main operator, with 31% market share in terms of subscribers is Net Brazil with 3.1 million internet cable subscribers, followed by Cablevision Argentina with 1.026 million subscribers. Compared to the second quarter of 2009, the Latin American market grew by 22.7% (8.149 million in Q209). With 10 million of broadband subscribers, the penetration is approaching 50% penetration of Cable TV subscribers. In Europe, for comparison, this penetration reached about 33%.

Quarterly Evolution of Broadband Cable inLatin America in Q2 210

Source : Dataxis Intelligence

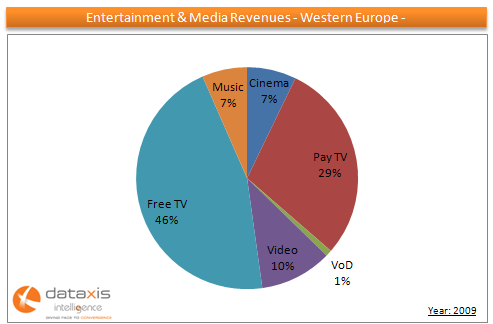

Dataxis to Launch New “Entertainment & Media” Market Research and Analysis Service

Monday, September 27th, 2010

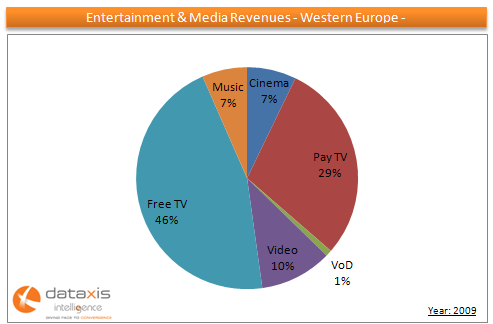

Leading provider of Telecom & Media market reseach and in-depth analysis, Dataxis, will soon launch its new “Entertainment” research service. The service provides extensive coverage of the Cinema, Video on Demand, Video, Pay and Free TV markets, as well as the music industry worldwide. .

As part of this research, Dataxis is pleased to provide a brief summary of the situation of the Entertainment & Media market in Western Europe as of 2009.

Revenues from Cinema, Video, Video on Demand, Pay & Free TV and Music in Western Europe reached US$110 billion at the end of 2009, down 8% year-over-year. The decrease was mainly attributed to the abrupt fall in the Free TV and Video (DVD and VHS) markets, and, to a lesser extent, to the decline in Music (Physical and Digital) revenues. While Cinema and Pay TV remained stable, Video On Demand showed the brightest performance in terms of growth. However, with hardly 1% market share in the Entertainment & Media (E&M) market, the small yet promising segment still does not have a strong weight in shaping the image of the E&M industry.

Dataxis’ “Entertainment” research service also covers hardware sales (TV sets and DVD/VHS players), with historical data from 2000 to 2009.

For more information, please visit www.dataxis.com or contact: Nicolas Gangloff. E-mail: Phone :

Maroc Telecom gaining momentum in Mali

Friday, September 24th, 2010

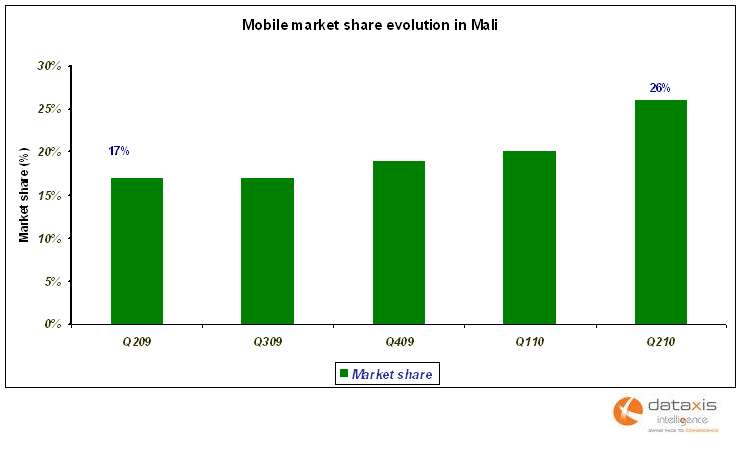

Morocco’s incumbent telecommunications operator also known as Itisalsat Al Maghrib (IAM), is more and more establishing itself as one of the key players at the continental stage with footprint in 4 African markets: Mauritania, Gabon, Burkina Faso and Mali. As far as the latter is concerned, the Rabat-based Group entered the market last year through the acquisition of a 51% stake in the State-owned Sotelma for $302.5 million and started to streamline operations in order to better compete in the promising mobile market with Orange Mali –part of France Telecom Group- that holds a dominant position with more than 80% of customers by that time.

Morocco’s incumbent telecommunications operator also known as Itisalsat Al Maghrib (IAM), is more and more establishing itself as one of the key players at the continental stage with footprint in 4 African markets: Mauritania, Gabon, Burkina Faso and Mali. As far as the latter is concerned, the Rabat-based Group entered the market last year through the acquisition of a 51% stake in the State-owned Sotelma for $302.5 million and started to streamline operations in order to better compete in the promising mobile market with Orange Mali –part of France Telecom Group- that holds a dominant position with more than 80% of customers by that time.

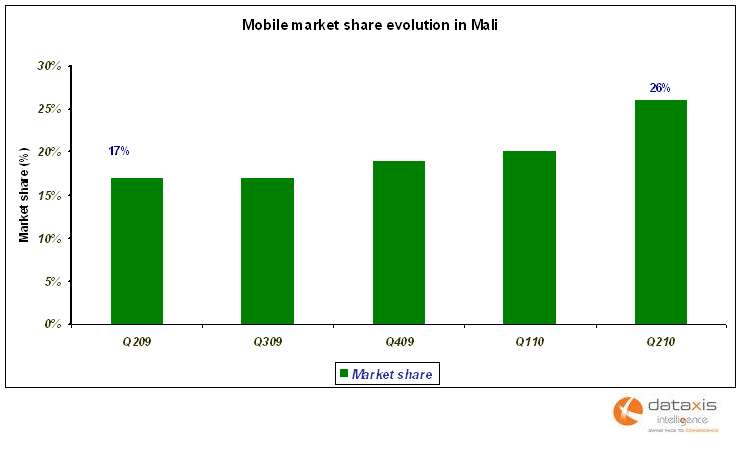

A year later, the outcome proves to be spectacular, as well illustrated on the chart below, in fact, Sotelma managed to rise its share of the mobile market by almost 10 points from hardly 17% in Q2 2009 up to 26% by June-end 2010. Moreover, in the last reported quarter, the performance was an outstanding one; since the operator gained 6 points, by raising its customer base from 911,000 to more than 1.4 million.

Thursday, September 23rd, 2010

KDDI published its results for the end of June 2010. Operating revenues of the company grew by 1.4% compared to previous year. Mobile business revenues stagnated while the fixed line business increased by 3.3%. This growth can be explained by the increasing number of fixed access lines, which reached 6.11 million in June 2010.

KDDI published its results for the end of June 2010. Operating revenues of the company grew by 1.4% compared to previous year. Mobile business revenues stagnated while the fixed line business increased by 3.3%. This growth can be explained by the increasing number of fixed access lines, which reached 6.11 million in June 2010.

KDDI’s cable phone service, called Cable-plus phone, reached 1.062 million subscribers in the first half of 2010, compared to 697.000 subscribers in June 2009. It represents a growth by more than 52% yoy.

According to Dataxis Intelligence, the market is still dominated by J:Com, with 1.8 million cable phone subscribers, but negotiations on an alliance between KDDI, J:Com and Sumitomo is planned to boost Cable TV operations and their customer bases.

U.S. Pay TV Revenues Top US$ 21 Billion in Q2 2010

Wednesday, September 22nd, 2010

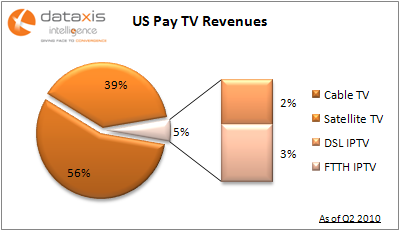

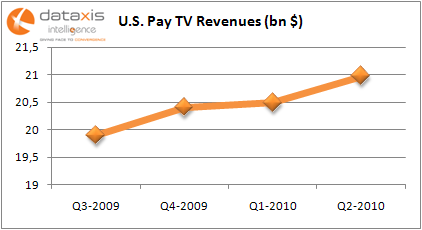

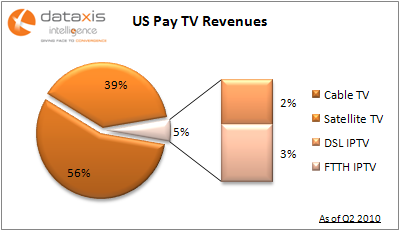

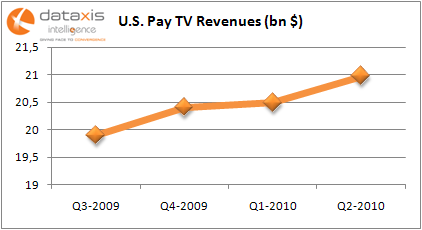

US pay TV Revenues increased 24% in the second quarter of 2010, reaching US$ 21 billion as of June 2010. Cable accounted for 56% of revenues, satellite made up for 39% and Fiber and DSL IPTV represented 3% and 2% of pay TV revenues respectively.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Detailed figures and analysis of Q2 2010 pay and free TV revenues will soon be available through Dataxis Intelligence’s market research service.

Tuesday, September 21st, 2010

In the quarter to June 2010, the mobile communications market in Tunisia has experimented an outstanding growth in terms of new subscriptions to wireless services according to Dataxis Intelligence latest updates. As a matter of fact, overall mobile phone users (SIM cards) jumped by 8.5% to more than 10.7 million and thereby, sending the penetration rate to over 100% of the population which theoretically means that everyone has his own mobile number.

In the quarter to June 2010, the mobile communications market in Tunisia has experimented an outstanding growth in terms of new subscriptions to wireless services according to Dataxis Intelligence latest updates. As a matter of fact, overall mobile phone users (SIM cards) jumped by 8.5% to more than 10.7 million and thereby, sending the penetration rate to over 100% of the population which theoretically means that everyone has his own mobile number.

It is important to notice that the bullish situation in Mobile market in Tunisia has been triggered by a revival of competition due to the arrival of France Telecom in the market under its Orange brand with cutting edge offerings such as 3G services.

As illustrates it well the pie chart below, the incumbent Tunisie Telecom and new entrant Orange Tunisie proved to be the key growth drivers in the quarter with respectively 45% and 35% of the 838,000 new customers gained by the industry between March and June 2010, whereas Tunisiana part of the Qtel Group made do with less than 20% of net additions.

Source: Dataxis Intelligence

Leading media company Modern Times Group (MTG) has just released its results for the third quarter and nine months ended 30 September 2010.

Leading media company Modern Times Group (MTG) has just released its results for the third quarter and nine months ended 30 September 2010.

The Digital Cable market in South Korea is very competitive with tens of Cable systems operators. In June 2010, this market reached 3 million subscribers, in a 15.225 million cable subscribers market. It represents a digitalization of 20%.

The Digital Cable market in South Korea is very competitive with tens of Cable systems operators. In June 2010, this market reached 3 million subscribers, in a 15.225 million cable subscribers market. It represents a digitalization of 20%.

Among all media, Television was the one that benefited most from the rebound in ad sales. TV channel 2M, which was established in 1989 by the largest Moroccan economic conglomerate ONA before being sold to the state 7 years later, saw its ad revenues jump 35% in H1. Al Aoula, owned by Morocco’s public broadcaster SNRT, enjoyed a 20% increase in advertisng sales in the first semester. However, for the newspaper and magazine sector, ad expenditure stalled, as the industry faced an increasing competition from outdoor (30% in H1) and a rising popularity of radio in Morocco (+9% in H1).

Among all media, Television was the one that benefited most from the rebound in ad sales. TV channel 2M, which was established in 1989 by the largest Moroccan economic conglomerate ONA before being sold to the state 7 years later, saw its ad revenues jump 35% in H1. Al Aoula, owned by Morocco’s public broadcaster SNRT, enjoyed a 20% increase in advertisng sales in the first semester. However, for the newspaper and magazine sector, ad expenditure stalled, as the industry faced an increasing competition from outdoor (30% in H1) and a rising popularity of radio in Morocco (+9% in H1). .

.

According to

According to

KDDI published its results for the end of June 2010. Operating revenues of the company grew by 1.4% compared to previous year. Mobile business revenues stagnated while the fixed line business increased by 3.3%. This growth can be explained by the increasing number of fixed access lines, which reached 6.11 million in June 2010.

KDDI published its results for the end of June 2010. Operating revenues of the company grew by 1.4% compared to previous year. Mobile business revenues stagnated while the fixed line business increased by 3.3%. This growth can be explained by the increasing number of fixed access lines, which reached 6.11 million in June 2010.